Looking to satisfy your curiosity about whether or not MicroAcquire is legit? This MicroAcquire review will be all you need to learn everything about it!

Flipping startups is arguably one of the smartest business moves. If you’re business-oriented, you can make a fortune from flipping businesses on a startup acquisition marketplace such as MicroAcquire.

And it works both ways, whether you’re the one selling or you’re the one buying.

In this elaborate MicroAcquire review, we’ll tell you everything you need to know about the platform.

Reviewing MicroAcquire: what is it?

Making strategic business acquisitions can be hard for both buyers and sellers. With MicroAcquire, however, this acquisition is now easier.

A platform where founders and buyers can connect, MicroAcquire is the ideal venue to sell your startup in 30 days or less.

It has more than 120,000 members, and the community is the result of its founder’s entrepreneurial journey. He saw how difficult it was to sell a startup, so he developed MicroAcquire to make it easier.

The platform facilitates interactions that lead to sales by connecting you with genuine buyers who are interested in digital enterprises.

You can sell quickly and save time and effort by avoiding brokers and bank services.

Since its start, MicroAcquire has rapidly expanded and currently boasts more than 60,000 active users and registered buyers.

MicroAcquire review: how does it work?

The answer depends on who’s asking.

Are you interested in buying or in selling a startup?

MicroAcquire allows you to do both. You can buy startups on MicroAcquire and even sell them.

It all begins with pressing the “Join now” button on the MicroAcquire homepage and creating a free account.

The platform allows you to explore the marketplace for free, even as a basic user, to see what startups are available for sale.

For purchasers, a premium subscription is provided to access additional tools that will facilitate your search. For a $390 annual charge, you can have access to special stats and opportunities for direct negotiations.

MicroAcquire review: how does it make money?

Any MicroAcquire review will tell you that the marketplace doesn’t charge any fees or sales commissions in contrast to its competitors.

However, it still makes money by charging prospective users an annual membership fee depending on the package they sign up for.

Of course, they also offer free memberships. But their paid membership ranges from $390 to $780 per year for serious users.

Considering that MicroAcquire has more than 100,000 members, if only 20% of that number are premium members, you can imagine how much money they make per year.

Reviewing the features of MicroAcquire

There are so many MicroAcquire features that make it the choice of many.

Listed in this MicroAcquire review are some of the features before a sale is closed.

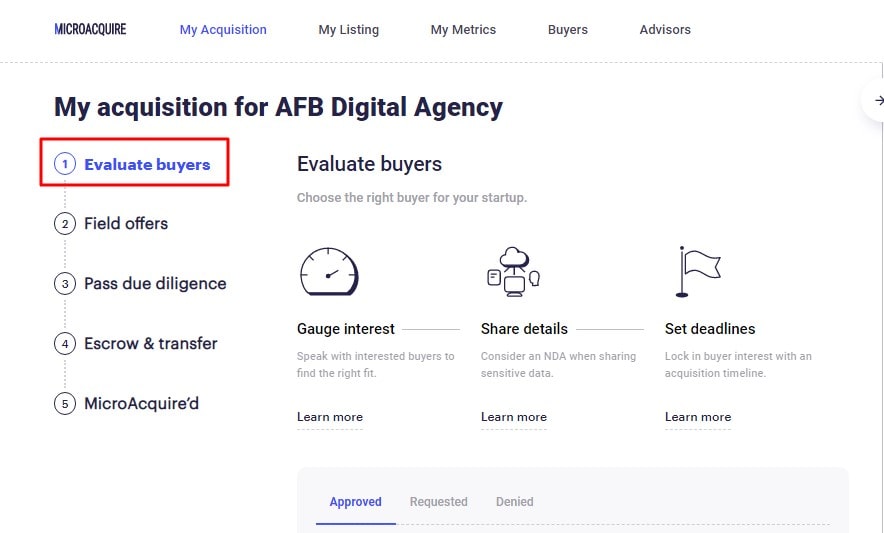

Buyer evaluation

If you’re a seller, you have the opportunity to evaluate your buyers and filter the serious ones. This lets you choose the right buyer to sell your startup to.

Not only that; you can also:

- Gauge Interest: You can gauge buyers’ interests by having the chance to speak with them if you want.

- Share Details: You can share details with potential buyers to help you persuade them.

- Acquisition Timeline: You can lock in a buyer’s interest and give them a deadline. After your given timeline, you can decide to switch to more serious buyers.

- Buyer’s Status: You can view the status of your buyers and know which ones you approved, which ones have made requests, and which ones you denied out of your discretion.

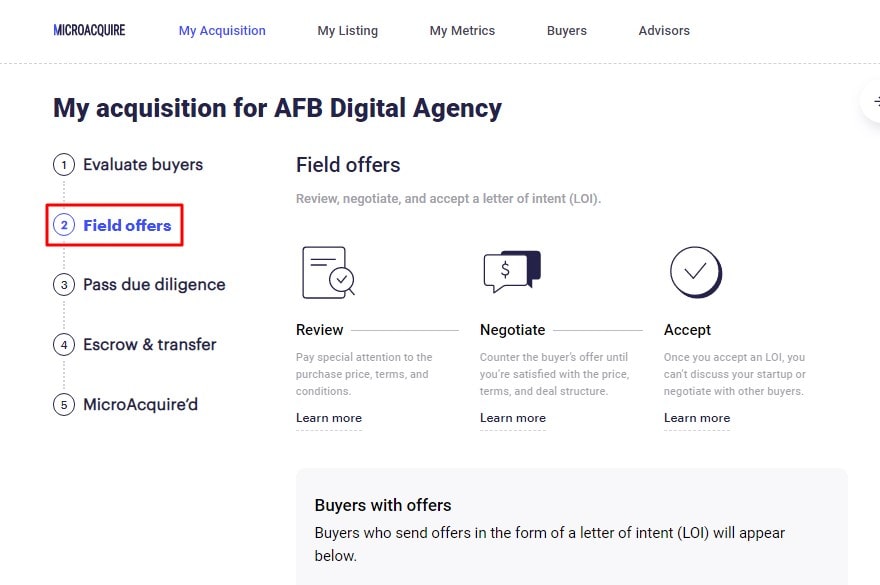

Field offers

Under this feature, you can review offers on MicroAcquire, negotiate offers and even accept a Letter of Intent.

You can do the following:

- Review: Here, you have the liberty to check the price, terms, policies, conditions, etc. before you make the buying or selling decision.

- Negotiate: You can easily negotiate the price and the terms until you’re satisfied before you buy or sell your startup.

- Acceptance: Under acceptance, once you accept the Letter of Intent from a potential buyer, you may not talk about sales of your startup with other buyers.

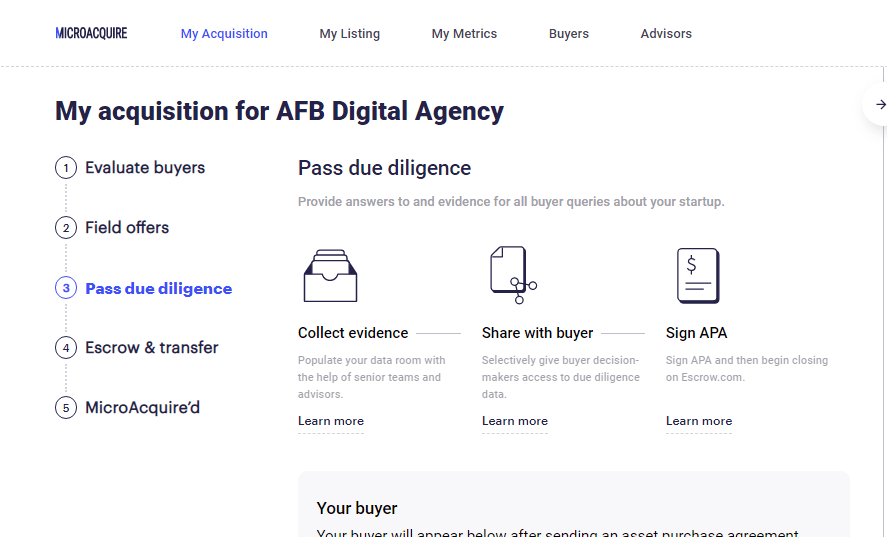

Pass due diligence

Under this feature, you can answer all questions posed by potential buyers and provide all the data they request. Apart from that, you can also:

- Collect Evidence: With the help of senior teams at MicroAcquire, you can collect all the necessary documents you need or want.

- Share With Buyers: Important data related to your startup can be selectively shared with potential buyers.

- Sign Asset Purchase Agreement (APA): This is where you and your buyer sign the documentation that shows that you’re about to seal the sale of a startup.

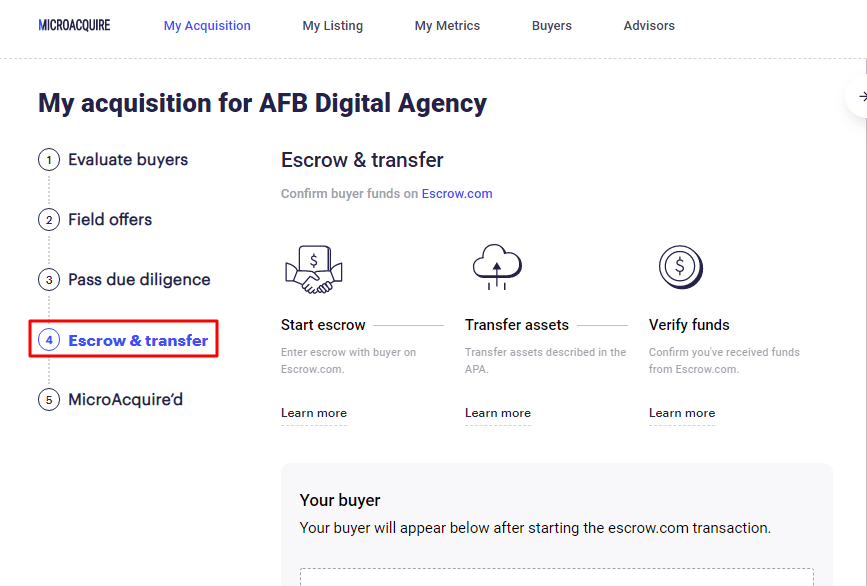

Escrow and transfer

Once the sale is made, money is deposited in escrow, ready for transfer. This will be released after the transfer of the startup has been made.

Under this feature, you can:

- Start Escrow: This is the feature in this stage where you and the buyer enter the Escrow platform to initiate the sale and transfer.

- Transfer Assets: This is where the asset you’re selling will be transferred to Escrow for safekeeping.

- Verify Fund: Here, you need to confirm you have received the fund. Once this is done, the asset will be released by Escrow.

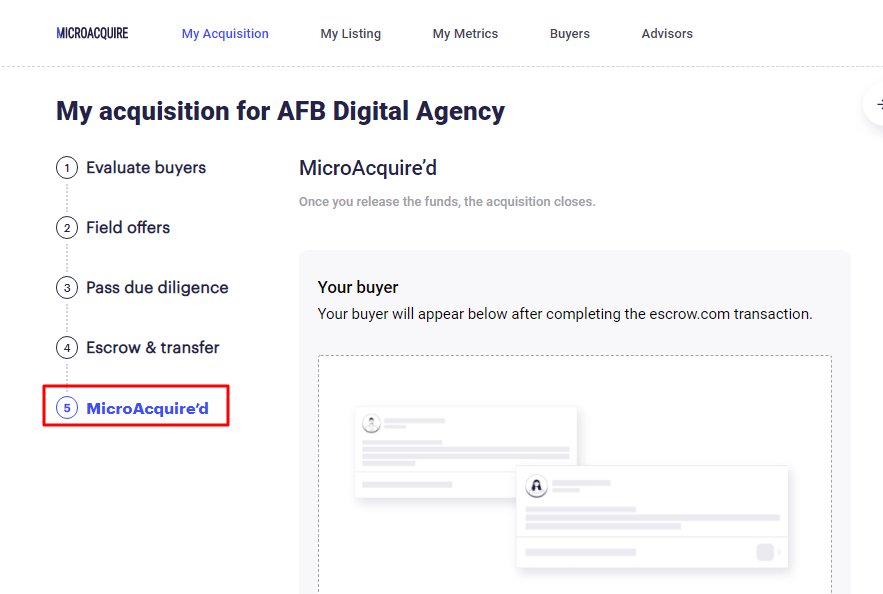

MicroAcquire’d

Under this feature, a specific transaction is said to be completed. It means that a startup has just been bought or sold.

They offer three types of membership pricing, as follows:

Basic plan (free)

This plan is for aspiring business acquirers who wish to browse before searching for their desired startups.

It allows users to browse the marketplace for free and view startups listed publicly.

Premium ($390/year)

This plan is for career entrepreneurs who are prepared to locate and buy their next business. Users can get in touch with the founders to talk about acquisition.

Under this subscription, you can access qualified startups with TTM revenues of up to $250,000 without restrictions.

Platinum ($780/year)

This plan allows users to access verified startups of all sizes without any limit.

For buyers seeking to acquire MicroAcquire-vetted startups, this may be the best subscription plan.

MicroAcquire review: how to sell a startup on MicroAcquire

To sell a startup on MicroAcquire, you need to follow these steps:

Account creation

MicroAcquire requires a domain-attached email or a LinkedIn account for users to sign up. Once that’s done, creating a profile is a fairly simple procedure.

At that point, you need to answer important questions. Before the listing goes online, the seller is responsible for creating profitability reports, growth projections, and a pitch deck for the business.

You can then publish the listing live and respond to private questions to gauge interest.

Here are the steps to follow to create an account as a seller:

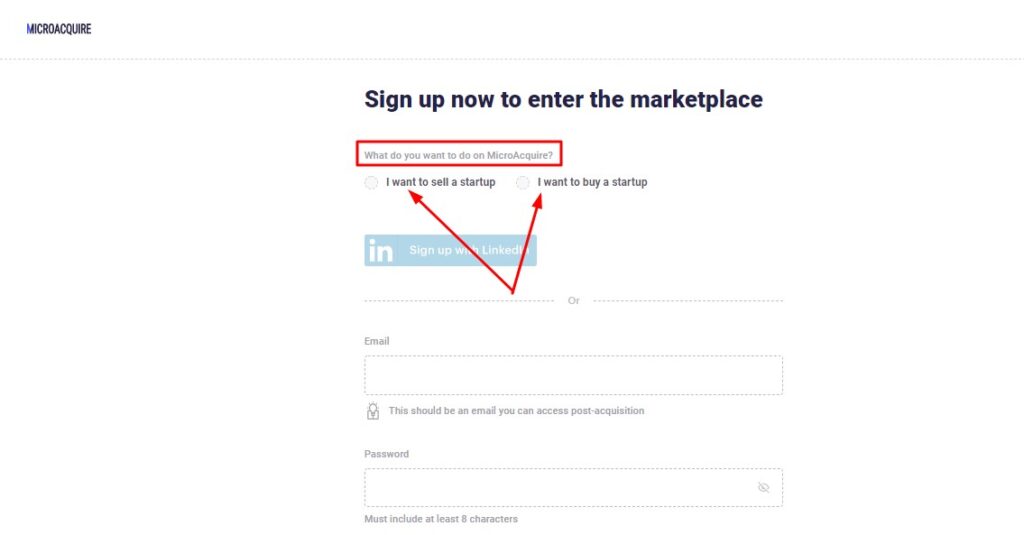

Step 1: Sign up

Visit the sign-up page and choose the one relevant to you as a buyer or a seller.

Step 2: Pick what you want to do on MicroAcquire

Pick if you want to sign up via email or through your LinkedIn profile.

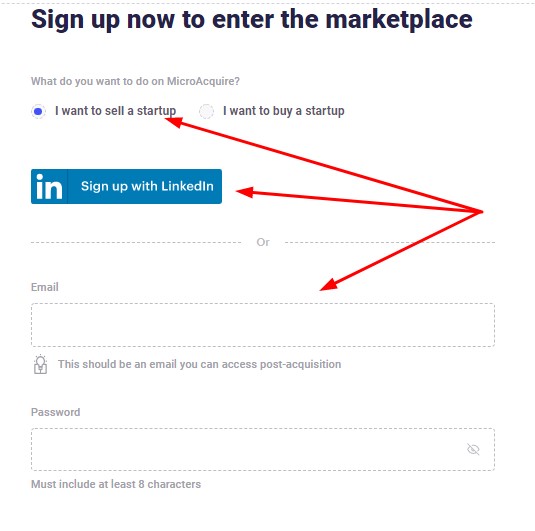

Step 3: Fill in your details

Choose to sign up with LinkedIn or fill in your details, then click “sign up.”

Step 4: Confirm your email address

An email will be sent to the email address you provided. Visit your email inbox and search for the email you got from MicroAcquire.

Once you find it, click the confirmation link to confirm your account.

Step 5: Fill in other necessary details

Fill in all the details you’re presented with to allow MicroAcquire to help you down the line.

Step 6: Take the tour

At this stage, you can choose to take the tour by clicking next on this page. Or you can cancel.

Step 7: Complete your listing

The next thing is to complete your listing. The startup you want to sell should be completed here.

Step 8: Browse the marketplace

If you’d rather browse the marketplace, you can do that, too.

Step 9: Create your profile

Click “Create Profile” under “Private Information” to fill in your necessary details. This information will be private and not visible to the public. Repeat the same thing under “Public Information”.

Connecting sellers to buyers on MicroAcquire

On the MicroAcquire platform, startup buyers can view essential statistics and information to determine which companies appeal to them and which ones they wish to pass on.

Buyers can then privately message the seller, and negotiations and conversations can start.

The vetting process before making a deal

One of the things you should know about the MicroAcquire review is the vetting procedure on the platform.

Prospective buyers will want certain data to thoroughly investigate the offer, including confirmation of revenue figures, views of growth projections, and market outlook.

They may object to some of the conclusions, in which case the pricing negotiations may change.

Giving access to things like Google Analytics or pictures of revenues should be expected, as vetting is an important aspect of the process between the buyer and the seller.

Terms and conditions of sale

A letter of intent is given by the buyer once the buyer and seller have reached an agreement.

Acceptance by the seller of this letter means that the deal is finalized. What follows next will be formalizing the contract and carrying them out.

Sale and post-sale support

If the parties uphold the terms of their agreement, the seller will receive payment from the buyer, transfer ownership of the business, and close the deal.

So, if it has been included in the agreement of sale and the terms of sale, then the seller provides support to the business throughout the period agreed upon.

On the other hand, if you’re a beginner on the platform, it is recommended that you opt for an expert guide.

To be properly guided by an expert at a fee, you can click on “Advisors”. You can even filter them based on your preference. Or you can just send an email to the MicroAcquire support team at [email protected].

If you want a detailed video tutorial on how to sell on MicroAcquire, we recommend you watch this video made by the founder himself.

MicroAcquire review: how to buy a startup on MicroAcquire

If you’re a buyer, simply choose from the beginning of the signup page that you’re trying to buy a startup. Then fill in the details following the prompts.

The buying process will be influenced by the skills and experience of the buyers and sellers.

MicroAcquire is the middleman who connects hot leads with eager purchasers. They are not a broker who provides specific support.

Here are some things to know if you want to buy.

Step 1: Check for listing information available publicly

Buyers who have registered with MicroAcquire are the only ones who have access to the listing information. Therefore, no information is simply available for public viewing.

What the business performs, its specialty, the seller’s motivation for selling, the asking price, a growth prediction, capital or funding possibilities, and the seller’s pitch deck are among the details that sellers give to potential purchasers.

The seller receives information and responds by providing the website URL, business name, or any other pertinent information required for the negotiation in a private exchange with possible purchasers.

Step 2: Check to see if private listing information is available

The vendor will determine this. Typically, they will be the ones to provide information such as website address and data needed for screening and due diligence throughout the negotiation.

The seller has control over this process because they are negotiating directly with prospective purchasers.

Step 3: Do your due diligence before you buy

The buyer is primarily responsible for verifying the facts and determining a reasonable price.

In essence, MicroAcquire only serves as an introduction. After that, it is up to the buyer to conduct thorough due diligence before deciding whether to purchase or not.

Step 4: Migration handling

This is solely between the buyer and vendor. They must devise a suitable plan for escrow and migration and assign their tech staff to take care of the technical aspects.

Step 5: Post-sale support

MicroAcquire doesn’t provide any post-sale support. After all, it’s simply a marketplace that links buyers and sellers.

Before the transaction is finalized, all post-sale support from the seller needs to be agreed upon in writing.

Watch this detailed tutorial to learn how to sign up as a buyer, filter your listing, and go through the process of acquiring a suitable startup.

MicroAcquire review: pros and cons

Let’s start with the benefits of MicroAcquire.

Reviewing the pros of MicroAcquire

You get valuable insights to make more informed offers

You can sign up for premium membership as a buyer to quickly search for startups.

To find the startup you’re looking for, use the price, revenue, keyword, and category filters. Utilize more than 15 different metrics to select a business that meets your needs.

You can sell your startup in 30 days or less

MicroAcquire has streamlined the sales process by establishing a marketplace.

You will start receiving offers from buyers on the platform as soon as your startup is listed. This makes it simpler to get in touch with the right people and raises your likelihood of securing a deal.

You get to be part of a buyer’s community

In an exclusive Facebook group, premium members converse about new acquisition opportunities, marketing tactics, user feedback, and other topics. You get access to all that learning when you subscribe to MicroAcquire.

You can learn easily with free resources

They have a YouTube channel where you can watch instructional videos while studying. Here, you’ll learn to handle offers wisely and get ready for acquisition.

They also share success stories that motivate business owners who want to sell their companies.

There are almost no fees, or no fees at all, for the buyer and the seller

This makes it a level playing field for both buyers and sellers since either party doesn’t have pay any fee.

It’s unlike most brokerage marketplaces where they charge as much as a 5% transaction fee on both sides.

There are a lot of hot leads for sellers to speak with serious buyers

MicroAcquire provides a lot of serious leads who are interested in buying the business.

It reduces the risk of having your time wasted by unserious buyers.

Buyers can choose from a wide range of business opportunities from eager vendors

All buyers have the opportunity to choose from the available businesses based on their budget.

Reviewing the cons of MicroAcquire

The following are the cons of MicroAcquire:

It offers almost zero sale support and migration support compared to many brokerages

One demerit of MicroAcquire is that it doesn’t ordinarily provide support during or post-sale. It’s all on you, the buyer and/or seller.

For novices, negotiations might be difficult

If you’re a beginner, things might be challenging to figure out.

Pricey membership fee

Their premium membership offers more features not available on the free basic version. Unfortunately, this premium status is not cheap compared to other platforms.

MicroAcquire review: best alternatives

Flippa.com

Through an auction mechanism, Flippa enables people to buy and sell websites (complete with content, traffic, communities, and money).

The website has made over $85 million in sales through Flippa to date, with a sell-through rate of over 50%. Additionally, the business runs Deal Flow, a high-end brokerage service.

A top international marketplace for digital assets, Flippa has overseen 300,000 deals since 2009. It has also sold a large quantity of assets at once, benefiting greatly from network effects.

You can identify qualified potential buyers, connect with them, and negotiate terms. It’s even possible to conduct due diligence and get paid by listing your online business for sale on Flippa.

Apart from that, it will also provide you with a professional appraisal based on your historical performance and asset type as part of the listing process.

Flippa charges a modest listing fee of $10 to $49 as well as a success fee of 5 to 15% of the total transaction amount.

To know how they compare, here is what a user, Stuart Goulden, has to say about MicroAcquire vs Flippa:

“I pay the $390 annual fee to be a member of the Microacquire buyers’ pool and have personally spent over $15,000 on small businesses on Flippa. Flippa is typbizbuysellically a better place to list content websites and tiny (under $50k) e-commerce firms, but Microacquire is a lot better platform for buying and listing high-quality SAAS goods. “

Stuart Goulden

BizBuySell

Bought by LoopNet, Inc. in 2004, BizBuySell is an online directory of commercial opportunities.

Customers can use it to buy and sell goods from other companies, including booze, clothing, and miscellaneous products. It’s headquartered in San Francisco, California, where it was formed in 1996.

Tiny Acquisitions

Instead of starting from scratch, why not build a startup for less than $100,000 through acquisition?

You can:

- Sort through small projects.

- Create deals using the platform.

- Discuss small project owners.

- Close the business on your terms.

- Connect your card and make purchases.

Yep, that is possible with Tiny Acquisitions.

A charming online platform for selecting projects up to $10,000, Tiny Acquisitions is geared toward enthusiastic business owners looking to advance a budding but tested concept.

You can handle everything entirely within the app, from offers and dialogue to invoicing and online payments via Stripe.

Small business postings can be viewed for free. However, potential buyers must purchase a $199 Premium membership to get comprehensive stats and proceed with a deal. Being able to make an instant purchase is a massive benefit if time is not your friend.

Although it isn’t quite as sophisticated as the other marketplace businesses, Tiny Acquisitions is still a potential location to sell projects online.

Dan.com

This marketplace is for buying and selling unused domains.

Listing a domain for sale or hire is simple, thanks to the no-nonsense online marketplace. Simply direct traffic to its own For Sale page, establish a price, and wait for the first offer to arrive.

Another choice is to rent your domain or allow the potential buyer to pay over time, but both come with higher costs.

Seeing how Dan.com has arranged over 100,000 domains, it’s easy to see that the process takes place easily, from the initial offer to transfer. Typically, payouts take 12 to 24 hours.

BitsForDigits

This marketplace has a pretty interesting approach to buying and selling a website.

It only engages in partial buyouts, bringing together creators of successful internet businesses and capital-rich investors searching for a nest egg.

You can choose who will receive your share of the business (1–99%), and listings are anonymous.

But even though BitsForDigits thoroughly screens prospective co-owners, they don’t become involved in the legal or financial aspects of a transaction.

They currently don’t charge any fees or commissions for their primary function of matchmaking.

Latona’s

Named after one of its co-founders, Latona’s started as an idea from a Harvard Business School experiment.

It’s a leader in online mergers and acquisitions and has been matchmaking entrepreneurs and investors with business opportunities that provide decent income streams.

Latona’s has the typical tools for determining the worth of your website, value-added professional services, and a respectable behind-the-scenes podcast.

BlogsForSale.co

A sister site to Niche Investor, BlogsForSale.co is into selling ready-made blogs.

It assists parties in purchasing and selling websites. In fact, the blogs you’ll see on the platform feature original content, confirmed monetization, and Google Analytics statistics. Although several are in their very early phases, there is no generic stuff here.

From launching a blog and increasing traffic to affiliate marketing and site valuation, BlogsForSale.co provides tools and guides that offer advice on every aspect of growing a site to selling it.

Investors Club

The Investors Club performs thorough due diligence for its members who pay an upfront payment of either £247 per year or $747 for lifetime membership.

In exchange, members get the advantage of receiving detailed reports and early access to opportunities.

The digital platform has a positive vibe for potential buyers and sellers who want frictionless transactions on top-notch websites.

It also offers 24-point buyer reports, which include traffic, SEO, niche analysis, competitive advantage, market share, growth plans, and domain health.

It also offers an added investment advisory service for agreements that are at least $20,000.

Motion Invest

Startup acquisition deals made by Motion Invest are typically valued at $20,000 or less.

The founder examines each listing before putting them up for sale. If you’re looking for a quick deal, Motion Invest also offers sellers a guaranteed sale from a satisfied buyer.

All listings, whether made through an affiliate or not, must be profitable. Sale prices are reasonable, and important indicators are quite transparent.

GetAcquired

Another newcomer on the block, GetAcquired specializes in purchasing and disposing SaaS-based startups. Its goal is to speed up and transform the conventional purchasing process.

Once you register, you will get access to a multitude of SaaS businesses for sale, complete with verified listings because of billing and analytics connections with Stripe, Recurly, Google Analytics, and the App Store. Listings are concealed from public view.

GetAcquired encourages sales. Therefore, they will arrange introductions, provide guidance on all areas of a deal, and can even join your team and negotiate the best price for sellers in exchange for a fee.

Before listing, and when it becomes clear that the service is just starting, pricing is not immediately apparent.

Although it is neither the largest nor the most comprehensive, it is one to keep an eye on.

Empire Flippers

A 500 Inc. company, Empire Flippers is a curated marketplace that has completed more than $200 million in profitable transactions.

Its primary transactions include affiliates, eCommerce stores, SaaS, subscriptions, portfolio firms, and Amazon sellers.

A flat 15% commission is levied on all sales less than $700,000. You receive the following benefits in exchange: vetted listings; promotion to a sizable pool of interested buyers; an 82% success rate; and concierge migration support when a deal is closed.

At each step along the process, the level of customer service is considerably higher.

They have a lot of experience in the industry and can understand the intricacies of negotiations that involve a cap table, deal structure, and intellectual property law.

Reviewing the top 3 MicroAcquire acquisition case studies

Are there real people who have bought or sold deals on MicroAcquire? Yes, there are.

In fact, here are a few case studies to go through:

Case study 1: Spencer Scott’s story

Spencer Scott was reading an article on IndieHacker and accidentally discovered MicroAcquire. He ended up buying a startup with a loan.

He almost shit in his pants after wiring the advance payment. But it turned out he got away with it.

Read about how Spencer Scott spent a whopping $280k to acquire a startup on MicroAcquire. And he was glad he did.

Case study 2: Ethan Parker’s story

Ethan Parker was an employee—a crappy employee, you might say—who turned out to be a great entrepreneur.

Read about how Ethan stumbled on the right business idea while working as a missionary up until he sold that idea as a business on MicroAcquire.

Case study 3: Jaisal Rathee’s story

Jaisal Rathee started working with startups when he was just 16. He’s now 28, and he has a lot of experience building and selling businesses.

Thanks to his wealth of experience, he has successfully sold five different startups on MicroAcquire.

Read about his story here to hear directly from the horse’s mouth.

MicroAcquire review: is MicroAcquire legit?

Yes, the MicroAcquire marketplace is entirely genuine.

From this MicroAcquire review alone, you can see it’s a great marketplace that actively assists customers in locating startup firms that they could be interested in.

This increases demand for the seller and gives them a variety of opportunities to negotiate a decent price with potential purchasers.

Several reviews from actual people who have made deals on the platforms agree that MicroAcquire is a trusted platform for buying or selling a startup.

Here’s a thread on Reddit about reviews from actual people. Here’s a second thread for your reading pleasure.

Final thoughts from this MicroAcquire review

The MicroAcquire marketplace is a fantastic choice for both buyers and sellers who are searching for a good deal on an online business that is lucrative.

Still, prospective buyers must do their homework, research the market, and consider the added benefits of each sale.

To ensure the asking price is reasonable, evaluate current ratings on software review websites and experiment with a few appraisal tools.

Don’t neglect the positives; be sure to examine your exit as well as the quick wins you’ll do to expand the site.