If you’re thinking of asking a startup studio to help turn your startup idea into a reality, you might wonder, “how much equity does a startup studio take?”.

While startup studios are a brilliant move, full disclosure: there’s a price to pay.

How much equity you need to give up boils down to the time and effort the startup studio world needs to invest in you.

If you need an elaborate discussion about this subject, this article is for you.

Image source: Pixabay

How Do Startup Studios Make Money?

The equity structure of startup studios (aka venture studios) depends on how much work they need to invest. The percentage could be as little as 15% or as much as 80%.

Regardless of the specifics, venture studios take an average equity stake of roughly 34% from the companies they help create.

So, if you have nothing but an idea, the equity you need to give up may be a lot. But, if you have almost everything ready and a bit of push in the right direction is all that’s left, startup studios may only take a small fee.

There are many opinionated talks about whether or not this is a fair thing to do. But, if you put things into perspective, you’re not the only one with a lot at stake in this arrangement.

On the off chance that your startup fails, the venture studio fails, too. Not only are they risking money on you, but they’re also risking the effort and time investment they gave you.

Here are relevant discussions:

The equity percentage depends on the startup studio model

If the venture studio business model is a 1st co-founder model, it receives 50%-80% equity.

On the other hand, 2nd co-founder studio models receive 35%-65% equity, while 3rd co-founder venture studio models receive 10% to 25% equity.

1st vs. 2nd vs. 3rd co-founder models

1st co-founder venture studio models are for founders with brilliant ideas but no (or less) expertise in moving forward.

Meanwhile, a 2nd co-founder venture studio business model is a startup struggling with its go-to-market strategy.

On the other hand, 3rd co-founder startup studio models are for established startups with flawed operations.

The logic behind why startup studios take equity

Considering how much equity a startup studio takes, you might be curious why you should let them do so.

Well, startup studios take equity as compensation for their role in furthering the growth of startups.

This makes sense, considering that they have startups’ backs at every step, from ideation, validation, and creation to the spin-in (or spin-out) and scale-up stages.

Why Allow Venture Studios to Take 34% Equity from My Company?

The idea of giving away a 34% equity stake in your startup is a hard pill to swallow. When you succeed, and every percentage of your startup is already worth billions, it would be as if you gave up billions.

But, because it’s only a cut out of the benefits that venture studios have in store for you, why not consider it?

Below are discussions about why giving 34% equity to startup studios is the right call.

Receive Over $230,000 in Funding

A venture studio raises the capital that startups can use for operational expenses. They get this money from entrepreneurial leaders who know how to build new companies.

For example, Jeff Bezos, founder of Amazon, invested $12.5 million in Pioneer Square Labs, an American startup studio.

With this investment, Pioneer Square Labs can provide startups with seed funding or initial capital.

Tips on what to do with the $230,000 funding:

1) Deliver on your promises

Take actionable steps and prioritize the requirements of the venture studio model. For instance, if the venture studio requires you to build a product within 18 months, this is what you should do.

2) Streamline current operations

Review your operations and identify opportunities for improvement. Hire an extra set of hands, align your marketing and sales, and install new programs if necessary.

3) Update the financial model

Evaluate cash actuals, balance sheets, forecasts, and more. The goal is to optimize your spending. Also, set aside money for your startup’s capital reserve.

Increase Your Chances of Going from Seed Round to Series A Funding

If venture studios provide you with starting capital, you should take it as an indication that they believe in your business idea. From there, it’s up to you to make the most of that opportunity.

A series A funding happens when venture capitalists or angel investors contribute to further the development of startups that underwent a seed round.

Getting a series A can be difficult. But, with determination and the right approach, you can tip the scales in your favor.

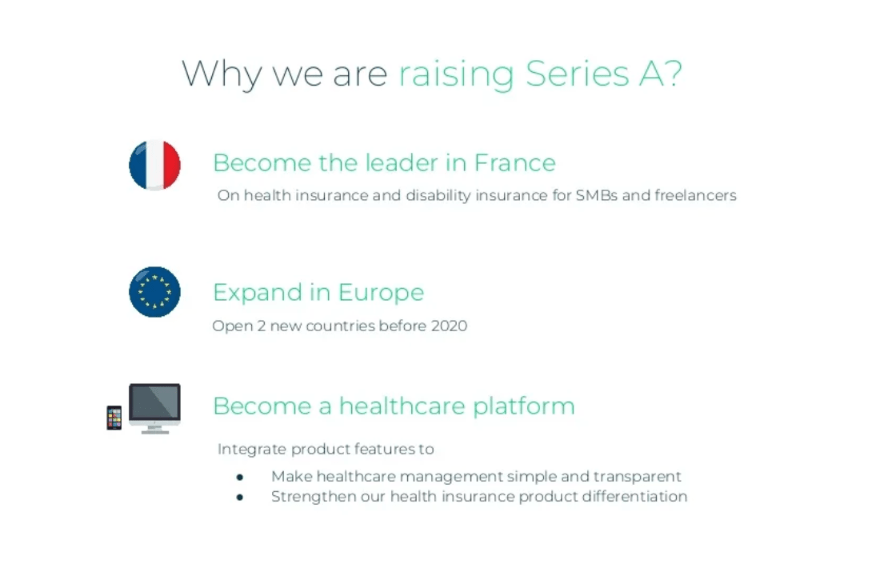

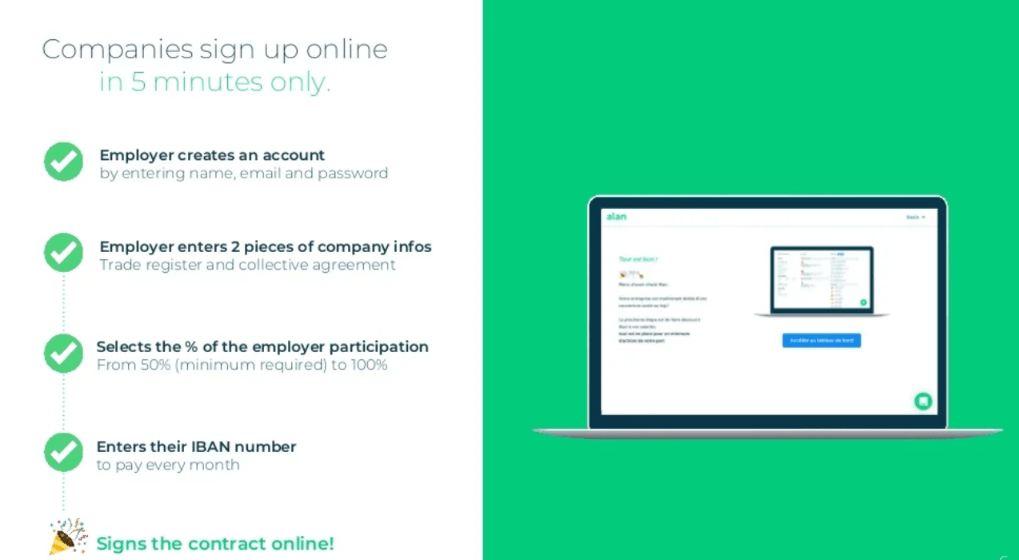

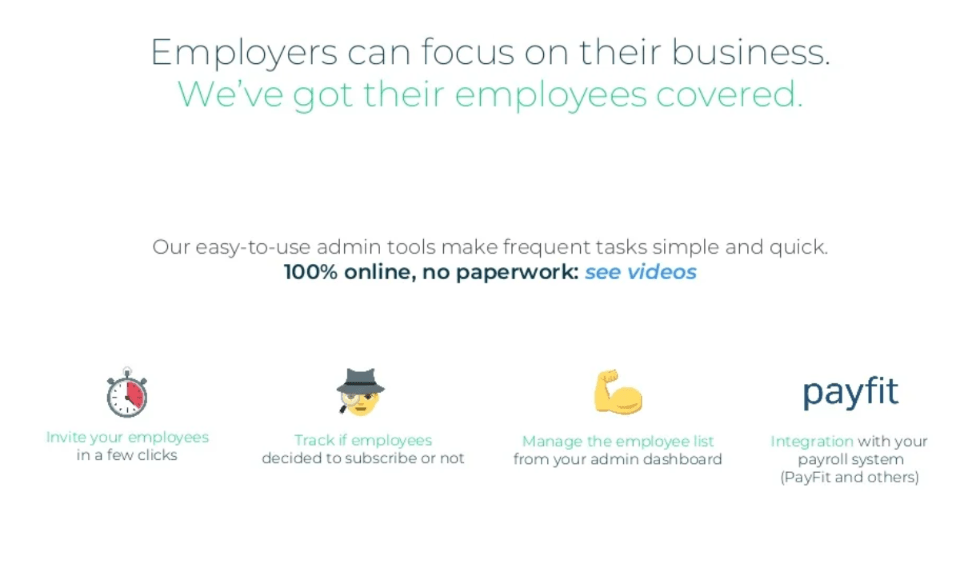

Alan, a health insurance platform in France, knows this. But while there are incoming obstacles, it persisted in raising series A funding.

Eventually, it raised $220 million at a 1.67 billion valuation despite the challenge.

In fact, the series of images above features Alan’s pitch deck focusing on vital details and the benefits of its product.

More importantly, it shows how it secured funding for company building and went on its way to becoming a successful startup.

How to increase your chances of raising series A funding:

1) Craft an excellent pitch deck

Design your pitch deck for series A funding. Elaborate on why you should level up from seed round venture funding to raising a series A.

Afterward, propose definite steps and detail realistic ways on how your venture studio model will advance to the next stage.

2) Learn relevant statistics

On average, a venture studio can help startups secure a seed round in less than a year — 10.7 months, to be exact.

From here, these startups are ready to raise a series A in 14 and a half months. In fact, 72% of startups groomed by startup studios make it to series A.

3) Have a forward-thinking approach

Focus on the benefits of raising series A funding. By then, scaling is faster because of better financial investment from more invested partners.

You also benefit from increased exposure, improved reputation, and better networking opportunities for your new company.

Works With a Proven Framework for Accelerated Growth and Scale

According to the whitepaper published by the Global Startup Studio Network, venture studios provide proper justification for the 34% equity they take.

Because they have a framework that successfully helps shape startups for the better, the studios are stringent about following it.

Below is the framework that venture studios typically follow.

1. Investigate

Venture studios start by helping startup founders source business ideas. They then evaluate the ideas and turn them into a business case.

At this stage, one of the primary objectives is to clarify a value proposition. They also perform competitor analysis and define idea hypotheses and assumptions.

2. Validate

In this secondary stage, the startup studio will test the idea-turned-into-a-business case.

The objective of this stage is to look closely into any evidence that indicates the business idea’s viability. This means dwelling more on customer discovery, user stories, and cost estimates.

3. Create

At this stage, the venture studio requests the startup to present a Minimum Viable Product.

The idea is to supplement the research conducted in the early stages. It will serve as “real-life proof” or solid evidence.

In addition to developing the MVP and iterating it based on the findings, the objective is to help the startup create a product roadmap and update its business plan.

4. Portfolio

At this stage, the startup studios have created successful startups. This means that the company launched is functional and can operate independently.

To commemorate this achievement, they will add the startup to their list of portfolio companies.

5. Scale

During this stage, the focus of startup studios is on scale-up efforts.

Because a startup became one of their portfolio companies, the objective is to present growth opportunities for its company-building efforts. They will explore markets, develop new products, and design management layers.

Ideally, this is the culmination of all the work they invested in making a startup ready to go public.

It’s where a company prepares for an acquisition or becomes an Initial Public Offering.

Conclusion

Now that you know how much equity a startup studio takes, you might be second-guessing if it’s a good move to work with one.

However, an incomparable benefit of startup studios is that they dramatically reduce the time it takes to create a startup and groom it to be ready for the public.

As they magnetize new talent and innovate ideas and business cases, they also minimize the risk profile of future investors.

So, if you encounter a downturn in your journey as a startup, try approaching a startup studio.

Even if it necessitates giving up a portion of your company, it increases your chances of emerging as one of the world’s most valuable startups.